Our vision of impact

Our goal is to fill the gaps where ethical & impact finance models have not yet trodden.

Impact is at the heart of what we do.

Finance is how we execute.

Robert Hayward

CEO, GoodFX

What’s our purpose?

GoodFX was founded in 2020 on the premise that financial technology is now developed enough to support a new form of economics.

If an ethical, transparent organisation can offer high levels of customer service, independent expertise, and positive business outcomes for its clients, but also use its profits to fund the impact its clients want to see in the world, then everyone can win.

This is our vision and is why we proudly became a B Corp company.

How we became a B Corp

When we set up GoodFX we knew we wanted our ‘purpose’ to be the very reason for the company’s existence, rather than an exercise in charity-washing.

We are a ‘Designed to Give’ B Corp and our donations are audited by a 3rd party examiner.

We want to walk the walk wherever we can. There is too much talking and not enough change. For us, being a B Corp means we are constantly examining ourselves to see where we can do better, and then putting it into action.

Yes, the B Corp movement attracts its critics, but there are few organisations that can integrate something as big and broad as ‘repurposing banking for good’ in a well articulated framework, with a viable pathway to change.

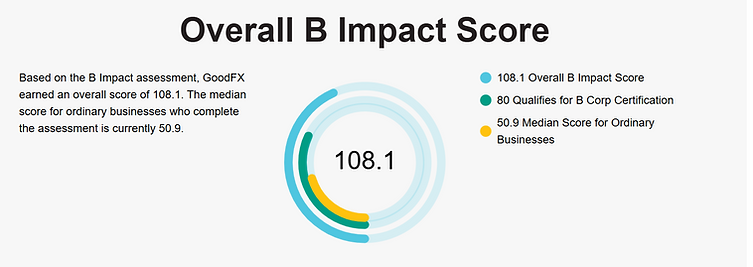

How do we rank?

Our latest B Corp score is below, and the full report is available on the B Corp website.

So much potential

In 2023 the global payments industry managed 4 trillion transactions, representing a value of $1.8 quadrillion, and generated a revenue pool of $2.4 trillion.

Yet emerging-market and developing economies will need an estimated $2.4 trillion annually by 2030 for climate and nature-related investments.

Charities around the world are facing a severe funding crisis. In the UK alone central government funding decreased by 33% from 2022 to 2023, while also individual donations have fallen by 14% in recent years.

Meanwhile nearly 72.1 million people remain displaced within their own countries.

Everybody wants to do more to help but frankly we all have jobs to do and shareholders to please. We cutting through that conundrum with financial and technological expertise.

Making a difference now

Waiting for reform of financial architecture and systems takes too long.

In the meantime, your organisation is letting money float off every day, sometimes to businesses who don’t align with your ethics at all.

We speak to your CFO on their terms - In a language of profitability, transparency, and process improvement.

By making their lives easier, our goal is to reduce and redistribute your normal business costs to fund impact on your behalf.

We would love to celebrate that publicly with you.